The world today is filled with huge amounts of knowledge about personal finance, whether it is from the hundreds of success stories you can find online or the many studies from experts and professionals on financial issues. That is why we decided to round up tips about money to help you with your personal finance problems.

Make sure to read through all our tips if you want to get the proper help.

Financial basics

1. Create a financial calendar

If you have a problem to remember every single time to pay your quarterly taxes or your credit card reports, then think about setting up reminders on your calendar for these important payments.

2. Check your interest rates

Do you have any active loans at the moment? Then make sure you pay out the one with the highest interest rate. What kind of savings account should you open? The one that offers the best interest rate when opening the account. Why is the credit card debt so high? Because you have not paid your debts on time and they are increasing over time because of the high-interest rate.

Basically, we are trying to show you what kind of mindset you need to have on these kinds of money issues. Constantly ask yourself questions about your current financial situation.

3. Keep track of your net worth

The difference between your debts and assets is the number which shows you your net worth. Net worth can show you a clearer picture of your overall financial status. If you keep an eye on your net worth, it may help you keep you informed of the progress you are making toward your personal financial goals or give you a wake-up call if you have started doing worse.

If you constantly have financial issues, learn more about other people’s success stories with similar personal finance problems.

How to repair a credit score

Credit repair for low-income households is no easy task, but it is still worth the effort.

Your credit score plays a major role in determining how much interest you’ll be charged on loans, what kind of loan terms you’re able to obtain, and even impact whether or not landlords are willing to lease an apartment. The most commonly used credit scoring system is FICO (Fair Isaac Corporation), which ranges from 300-850 with a higher score indicating better creditworthiness.

Paying off debt can be one of the most effective strategies for improving your credit score, as well as providing more disposable income for other expenses. When arranging payments with creditors, prioritize those that carry the highest interest rates first in order to minimize further penalty charges. Also, consider consolidating debts through loans or balance transfers in order to lower monthly repayments and improve budgeting control over debts.

Understand the contents of your credit report as mistakes can creep up on you without notice. It’s crucial that any inaccuracies are rectified at once by getting in contact with organizations that may have reported false details (e.g., public utilities).

If you’ve recently filed for bankruptcy, then doing whatever is necessary to rebuild your finances should be a priority whenever possible – ask yourself how long do bankruptcies stay on my credit report? Bankruptcies generally remain visible on your reports for 7 years – but it’s important to understand they won’t detract from establishing good financial habits afterward!

How to budget

1. Set a budget permanently

This is the starting point if you ever want to get out of your personal finance problems. You can follow a lot of personal budget guides that can show you how to get the best out of your budget.

2. Consider a cash-only diet

If you are overspending every time you get out then maybe an all-cash diet will get you out of that habit. An all-cash diet is when you only use the physical currency to handle all your daily expenses. For example, you would only use cash when filling up on gas, groceries, and other smaller daily expenses.

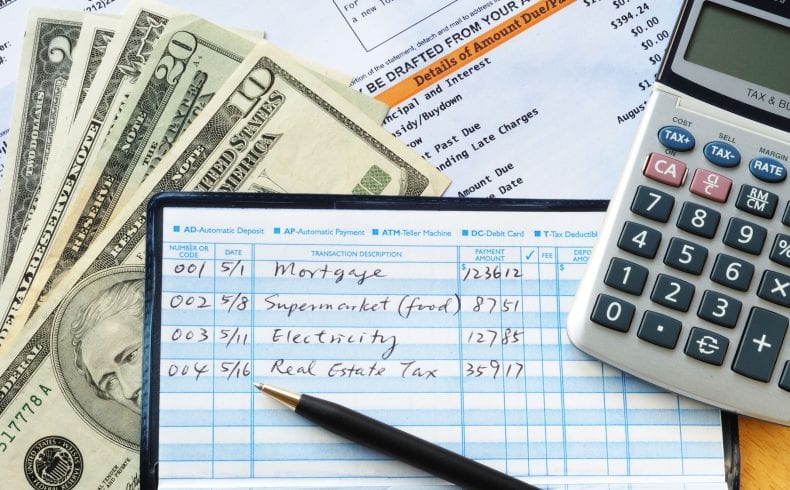

3. Daily money minute

A daily money minute is to set one minute a day to check on your financial transaction. This one minute act may help you identify your financial problems easily, keep track of your goal progress, and set your spending budget for the rest of the day.

4. Focus toward certain financial priorities

It is known to be a general rule in personal financing that you need to allocate at least 20% of your income toward priorities. These priorities can be for paying off your debt, emergency savings, your kids’ college fund, or even your retirement savings account. It may seem like it is a pretty big percentage, but it is definitely worth it.