The biggest challenge in the Demographic Bonus era that will occur in USA is personal or family Financial Planning/Management.

The lack of awareness of the USA people regarding Financial Planning / Management and the high level of public consumption have resulted in people not having clear financial goals and tending to spend money for short-term purposes.

After making a financial plan, a financial planner will convey the plan to the client. This stage is not carried out in one direction but in two directions. The financial planner will ask about the client’s opinion and willingness.

If the client feels the plan is not meeting his expectations, the financial planner can change the plan based on the feedback.

The Fiduciary Duty Is the Highest Standard of Care

Failing to uphold fiduciary duty has severe consequences for those entrusted with it, as it is the highest legal standard of care.

The fiduciary duty services usually include discussion and execution of investments for the benefit of the client concerned. Firms that provide this service are sought after by people who want to invest with many options, from funding to stocks. The services provided by wealth management include assisting in financial planning (financial planning), managing client portfolios, and various other financial services related to clients’ personal financial choices.

The fiduciary duty services are personally provided by large financial institutions. However, this service can also be provided by an independent financial advisor or a multi-licensed portfolio manager who offers a wide range of financial services focused on high-end clients.

What Happens if a Fiduciary Duty Is Breached?

The fiduciary will provide investment advice or recommendations based on the customer’s situation. These recommendations are usually in the form of a “portfolio” of financial instruments, such as investments in mutual funds, insurance, pension plans, foreign currencies, and others.

Recommendations may also cover non-financial assets such as property. Fiduciaries usually do not recommend specific stocks and also do not make investment decisions or directly manage customer funds because that is the expertise of the Fund Manager.

In practice, a Fiduciary may not provide comprehensive recommendations. It may only be limited to products available at the company where the Fiduciary works.

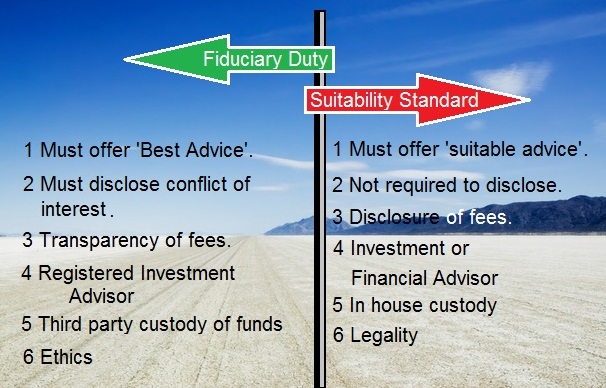

Fiduciary Standard vs. Suitability Standard

In fiduciary, advisors and clients will discuss the objectives, level of comfort, risk, and other conditions that must be borne by clients when investing their assets. The financial advisor then creates an investment strategy that links all the information the client provides to help the client achieve their goals.

Unlike suitability standards, fiduciaries cannot provide exclusive banking services to clients, nor can they help clients open bank accounts. But they can advise which bank account is best to choose. Personal financial advisor near me also have more discussions with their clients.

What Is a Fiduciary?

A fiduciary refers to a professional that is required by law to act in their client’s best interest. A fiduciary financial advisor makes investment decisions with your best interest in mind, while a financial advisor who isn’t a fiduciary may recommend products for which they receive a commission or other form of payment.

For someone who finds it difficult to manage finances, a financial planner is a right solution. It is true that everyone needs financial literacy. However, there are times when you also need a financial planner to help achieve the financial goals you have set. Many people do not know the profession of a financial planner. There are also those who equate it with a financial advisor. In fact, there are things that are different between the two.

Examples of Fiduciary-Client Relationships

Some of the responsibilities and fiduciary client relationships that must be carried out by financial planners are as follows.

Analyze the client’s goals and characteristics. Each client certainly has its own goals and characteristics. Therefore, the first thing a financial planner must do is analyze the goals and characteristics of the client. These two things will be the main benchmark in financial planning.

Evaluate the client’s financial condition. After knowing the goals and characteristics of the client, the financial planner must evaluate the client’s current financial condition. Some things that need to be evaluated include assets, income, expenses, savings, installments, and other needs.

From here, the financial planner will understand what things have not been properly carried out by the client.

Make a financial plan. The essence of the responsibility of a financial planner is to do financial planning. This plan will be tailored to the client’s current goals and conditions. In other words, the financial planner will bridge the client’s current financial position with the financial goals he wants to achieve.

Help carry out the plan. If the plan made by the financial planner has been agreed upon by the client, now is the time for the plan to be implemented. At this stage, the financial planner can help with several things related to the plan, such as opening an account, managing assets, and various things that are requested by the client.

Supervise the progress of the plan. When the financial plan has started to run, the financial planner can’t just hand it off. A financial planner must oversee the course of the plan. If there is an obstacle, the financial planner must help the client overcome the problem.

Is There a Difference Between a Fiduciary and a Financial Advisor?

Financial planners are divided into fiduciary and independent financial advisors. In general, the career path depends on the company they work for and the duration of the experience. Independent financial advisor an example of a financial planner’s career path in a financial consulting company, namely a junior planner, senior consultant, associate, then financial advisor.

Fiduciary financial planners: examples of financial planner career paths in insurance companies are agent, agency manager, senior agency manager, then agency director. Financial institutions or banks that have comprehensive wealth management programs are those that have complete services. For example, the investments offered are financial and non-financial products.

They also provide advice on types of real investments such as gold, houses, prospective businesses, and others. They are not even fanatical about their own products but are also open to the products of other institutions that are considered more suitable for our condition.

The most fundamental difference between private banking and wealth management is the variety of services provided and the freedom of consumers to choose. Even though wealth management has many advantages, it cannot provide exclusive banking services even though clients have large amounts of funds.