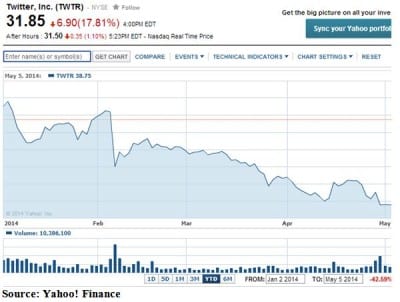

The shares of Twitter Inc (NYSE:TWTR) closed $31.85 per share, down by 17.81%. The stock further declined to $31.59 a share during the extended hours trading, around 5:09 P.M. in New York on Tuesday.

The huge decline in the stock price of Twitter Inc (NYSE:TWTR) was caused by the expiration of the lock-up period, which allows company insiders and early investors to sell their stakes in the company.

The expiration of the lock-up period covers 470 million shares of Twitter Inc (NYSE:TWTR). According to Reuters, 95 million shares on a consolidated basis were traded—six times its daily average volume during the afternoon trading today.

James Cordwell, an analyst at Atlantic Equities told Reuters, “The move is bigger than expected and is indicative of the negative investor sentiment towards Twitter right now. I am starting to think that sentiment might have got too negative, but I don’t see anything that can turn this around in the near term.”

Last month, Twitter CEO Dick Costolo disclosed in a regulatory filing that he has no intention to sell his stake in the company after the expiration of the lock-up period. His co-founders Evan Williams and Jack Dorsey as well as Benchmark Capital plan to keep their stockholdings.

Rizvi Traverse Management LLC, the largest shareholder of Twitter Inc (NYSELTWTR), which owns 85.2 million shares, had no intention to unload its stake in the company, according to a person familiar with the investor’s plan. Another investor, Lowercase Capital will not also sell its stockholding in the company.

Robert Peck of SunTrust Robinson Humphrey predicted that as much as 200 million share might still flood the market over the coming weeks even if the top executives and the largest shareholders of Twitter Inc (NYSE:TWTR) has no intention to sell their shares.

Take note that the stock price of the microblogging site had been affected by a sell off prior to the expiration of its lock-up period. One of the factors that negatively affected Twitter Inc (NYSE:TWTR) was Prem Watsa’s warning regarding a new tech stock bubble, and emphasized that investors who have stake in Twitter and other momentum stock will end up in tears. Investors were also unimpressed with the user growth of the microblogging company during the first three months of this year.

The current stock price of the popular microblogging company is the lowest since its initial public offering (IPO) in November last year. During its first day of trading, the stock price of Twitter Inc. (NYSE:TWTR) soared 73% from its offering price of $26 to $44.90 per share. The stock reached as high as $74.73 per share over the past 52-week range. The company lost more than 42% of its stock value year-to-date.