Tesla Motors Inc. (NASDAQ:TSLA) announced the introduction of its new business leasing program for small and medium size businesses.

The latest offering of the electric car manufacturer is an expansion of its existing lease-style financing called Resale Value Guarantee for individuals, which was launched in April last year. Under the program, its customers have the “option to return their Model S after three years for a known value and obtains a car loan from its banking partners allowing them to benefit from the $7,500 federal electric vehicle tax credit.

Businesses request leasing program

According to Tesla Motors Inc. (NASDAQ:TSLA) many of its customers took advantage of the Resale Value Guarantee. Its small and medium sized customers have been requesting for an easy and simple leasing program that allows business tax deductions. In response to the request, the electric car manufacturer introduced its leasing for business owners.

“Our leasing program is straightforward and transparent, and we’ve designed it to be user friendly. To begin with, business customers can easily see upfront their monthly cost of leasing while configuring their car on our website,” said Tesla Motors Inc (NASDAQ:TSLA).

According to the electric car manufacturer, its lease agreement is written in plain language and it is less than three pages. Customers will be able to complete the processing and sign their lease agreements electronically. They can also review an electronic version of the lease agreement prior to the delivery of their vehicles.

Tesla Finance unit

Tesla Motors Inc (NASDAQ:TSLA) created Tesla Finance, a subsidiary that will handle its lease program for businesses, the Resale Value Guarantee, and the loans from its banking partners. The electric car manufacturer emphasized that its financing options offer an attractive value proposition when combined with the fuel savings of Model S.

“A captive finance company is a natural extension of our strategy to offer great customer experience, including financing products important to customers,” according to Tesla Motors Inc (NASDAQ:TSLA). The electric car manufacturer said, Tesla Finance “will be funded with a combination of equity and a warehouse financing facility that will be announced shortly.”

In addition, the company said it will use some of the cash generated from the sales of Model S to provide funding for Tesla Finance emphasizing that it “makes sense” given a “solid cash position, strong cash flow from operations and the poor returns available on cash equivalents.”

Furthermore, the Tesla Motors Inc (NASDAQ:TSLA) stated that “additional layers of warehouse facilities would be added and eventually replaced with private and/or public asset-backed securitization transactions commonly utilized in the industry” once its business lease program achieve growth.

Momentum stocks sell off

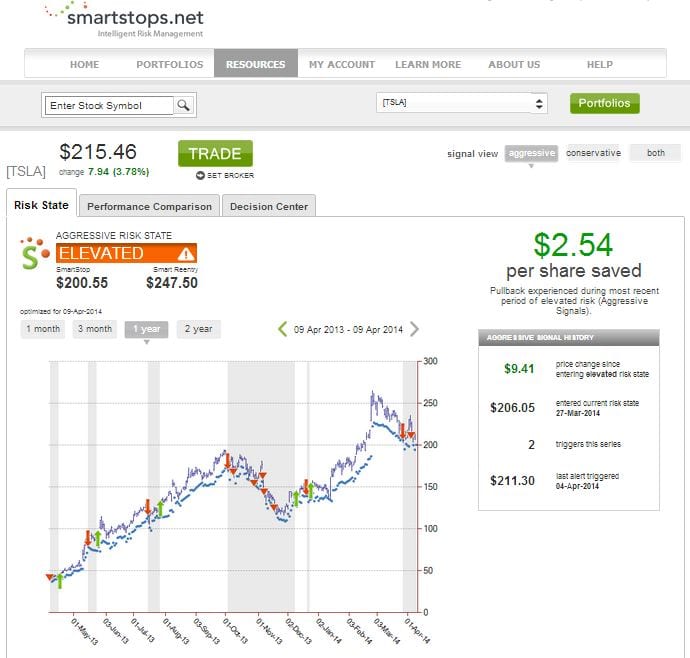

Tesla Motors Inc. (NASDAQ:TSLA) is considered one of the momentum stocks or the biggest gainers in the bull market. The shares of the electric car manufacturer declined 2.1% yesterday after a sell off of momentum stocks last week. The stock declined over 20% from its record high of $265 per share in February. The stock price of the company rebounded nearly 4% to $215.46 per share today.

Smartstops.net, a stock market risk equity management firm shows that the shares of Tesla Motors Inc. (NASDAQ:TSLA) are currently at an elevated risk. The stock fell into current risk state when the price declined to $206.05 a share last March 27. The members of the Smartstops.net receive real time alerts whenever the stock in their portfolio entered an elevated risk state indicating a continued decline in the equity’s price.