Every investor has heard at one point or another to not listen to any of the “talking heads” or “stock pundits”. Over the past several decades, the financial media has been blamed for overhyping and mostly for being wrong when it counted. And now with the Internet that spreads “news” instantaneously, publishers of “latest news” are indulging even more speculation. This time, the Wall Street Journal is in the hot seat. On Sunday, the Wall Street Journal published an online article that immediately became huge news for investors and traders. The article detailed a possible partnership between Apple Inc. (NASDAQ:AAPL) and Comcast Corporation (NASDAQ:CMCSA), which would allow Apple to stream Comcast TV on Apple products.

However, according to Dan Rayburn a research analyst, the article was overhyped and severely misguided readers. Rayburn, first starts off by adding that he has talked to several sources and it revealed that Apple was not in talks with Comcast to provide a streaming service. Rayburn also moves on to highlight another error in the article after the authors stated that “Apple would get special treatment on Comcast’s cables to ensure it bypasses congestion on the Web” (SA). However, this would be illegal. One can’t help but wonder given that the Wall Street Journal is now owned by Murdock, if more “tabloid” type of headline grabbing news will be generated.

The article appears to contain several errors and the authors had a hard time defining “bandwidth” and “flow” . Yet it created the stir. Netflix, Inc. (NASDAQ:NFLX) has dropped over $42 since then. Obviously, if this Comcast-Apple partnership were true and if there was an active attempt to bring Comcast streaming TV to Apple products, Netflix would be expected to take a hit. As far as the streaming marketplace today, Netflix is the leader. Investors are getting jittery over its overvalued valuation and news like this just spearheaded the parade to the door.

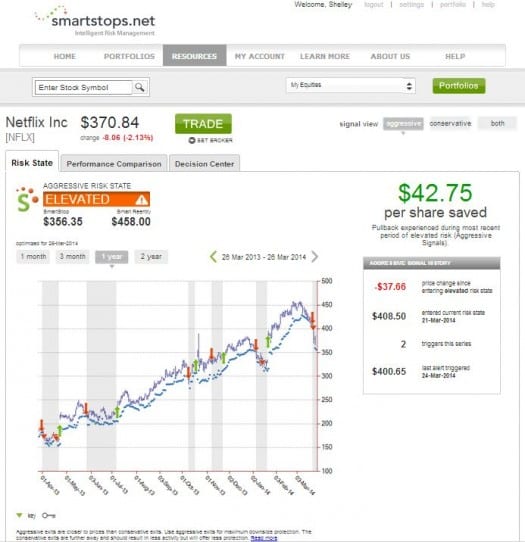

The past two days have highlighted the need for investors to have a proper exit or hedge strategy to help protect from losses in the stock. Subscribers of risk management service, SmartStops.net, receive alerts when their stock holdings reach an “elevated risk level” or price points to allow for setting of stops before the market opens. Thus all investors can be monitoring risk properly and avoid potential losses.

So far in 2014, SmartStops has alerted Netflix investors twice about elevated risk levels saving them over $90 per share in potential downside losses