The small island state of Malta has seen some of the most impressive economic recoveries of the past decade, with regular annual 5% GDP growth figures. With growth drivers including online gambling, tourism, and a controversial passport scheme, Malta’s real estate sector has been the standout investment opportunity on the island over the last few years. Incredibly, the sector has seen resilience throughout the COVID pandemic, as government moratoria on bank loans helped investors weather the storm. Can this strength continue for the rest of 2024? Should you invest in Maltese real estate today? Let’s examine the bull and bear cases.

The bullish case

Despite having an economy which is (depending on how it is measured) between 15-30% reliant on tourism, Maltese unemployment in March 2024 is barely above the levels from a year before. Much of this is thanks to the wage supplements paid for by the government of Malta, which has been spending a million euros a day – every day – for a year, to ensure that hotels and restaurants don’t fire their staff. This scheme has been extended to the end of 2024, adding confidence to the market. And given that a large proportion of such staff are migrants from the rest of the EU (and further afield) this has allowed the rental market to stabilize.

And on the tourism side, at the time of writing – March 2024 – vaccines seem to be working, albeit slowly, and Malta in fact leads the EU in vaccination rates. If all goes well, tourism should come back to reasonable levels in the coming years (if not the ‘business as usual by May’ mantra which the Maltese PM seems to believe in).

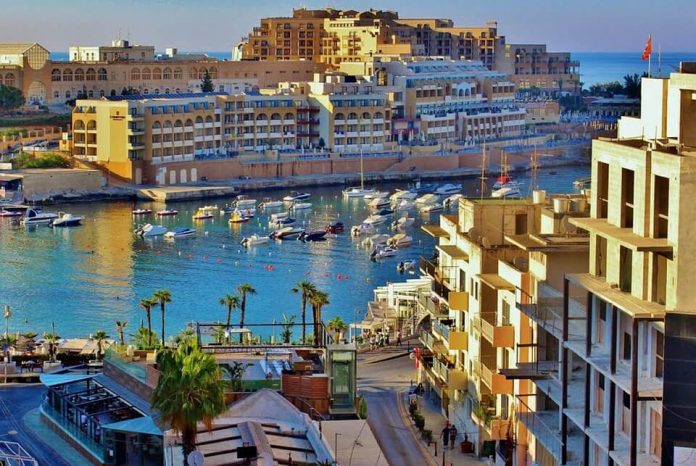

Furthermore, Malta has significantly diversified its economy since joining the EU in 2004 and is no longer totally reliant on tourism to the extent it was before. The big money industry on the island is remote gaming (online gambling), with thousands of Swedes, Germans, and Brits renting swanky apartments in the areas of Sliema and St Julians. In fact, this industry expanded during the pandemic, taking advantage of the fact that hundreds of millions around the world were stuck at home for months on end.

What’s more, quantitative easing by the European Central Bank (ECB) means that newly created money has to go somewhere, with real estate being the obvious choice. In Malta, it’s still relatively cheap to service home loans, especially as borrowers can take advantage of bank loan moratoria.

The bearish case

But it’s not all positive for Maltese real estate. New construction of apartment blocks has continued apace throughout 2024 and 2024, leading to a rather obvious glut of available housing stock. Much of this construction was planned to cater for the short-let markets (rented via Airbnb and other platforms), but the question has to be asked – when will tourism numbers return to 2019 levels?

Furthermore, the remote gaming industry in Malta itself faces headwinds. Consolidation in the sector has already seen live casino provider Evolution purchase rivals NetEnt, with the instant loss of 300 well-paid jobs. More such deals are known to be in the pipeline for 2024, which could add to more retrenchment and less demand for Maltese real estate – both commercial and residential. In an even more worrying development, other countries around the world are no longer happy to let gambling companies operate on their territory with a Maltese licence. In the past couple of years, both Germany and Sweden have regulated their own markets and now require a physical presence in each country, making an office in Sliema (and dozens of Nordic-speaking staff) less of an obvious choice.

While online operators such as Mr Green are legally obliged to maintain a staffing presence in Malta, the gambling affiliate industry has gone almost completely remote since the pandemic started. This has resulted in less and less demand for newly built, high-end apartments, and the market is seeing steep price falls. To add further potential misery for the online gambling sector, corruption scandals have dogged the last two CEOs of the local gaming authority, leading to resignations and potential criminal charges. Malta has done very well from internet gambling, but are the good times finally coming to an end?

One also needs to ask how much room the government has left to cut the cost of buying property. Stamp duty has been reduced in half, and as for interest rates, they can’t go much lower than they are now. What would happen if the ECB lost control of commercial rates and they go higher? Already, mortgage rates in the US have crossed the 3% rate, and if money shifts across the Atlantic in search of higher yields, the EUR/USD exchange rate might drop precipitously, which may drive up the interest rates European banks would be willing to lend at.

And the elephant in the Maltese real estate room is called MoneyVal. This European committee decides on white-, black- and grey- listing of various banking jurisdictions around the world, and we know that Malta is coming under heavy scrutiny. Already, Maltese banks struggle to raise US dollar funding due to reputational issues, with many online casinos unable to accept deposits in the world’s reserve currency. If Malta’s myriad financial and corruption scandals lead to a grey listing, this could seriously damage various industries on the island, and surely lead to a downward trend on property prices.

Conclusion

MoneyVal grey listings aside, Maltese real estate will probably continue to hold its value through 2024, thanks to the various government initiatives. If the tourism industry can bounce back even better than expected, then we might even see a sharp rise in property prices. But there are headwinds ahead for Malta, particularly the slow puncture of the gaming industry, and the glut of new builds hitting the market every day. We think that Malta will probably survive 2024… but the rest of the decade could be a different story.