Juniper Networks, Inc. (NYSE:JNPR) will reduce its global workforce by approximately 6% as part of its initiatives under the previously announces integrated operating plan (IOP) based on its latest regulatory filing with the Securities and Exchange Commission (SEC).

The computer networking company is under pressure to streamline its business operations by activist hedge funds particularly Elliott Management Corporation headed by billionaire investor Paul Singer and Jana Partners headed by Barry Rosenstein. In February, Juniper Networks, Inc. (NYSE:JNPR) announced shares buyback of more than $2 billion until the first quarter of 2015 and it will also start paying a dividend of $0.10 per share in the third quarter of this year. Its new CEO Shaygan Kheradpir stated that he joined the company as an agent of change, and promised to align its cost-structure under its IOP.

Juniper Networks, Inc. (NYSELJNPR) also disclosed that it will focus on high-growth segments and to right-size certain functions of its business. The company said it is taking a balanced approach to cost management and prioritizing and strengthening its focus on innovation that matters majority of its customers.

According to the company, the job cuts will immediately and significantly affect middle management positions, and expects to incur approximately $35 million cash charges for severance and other related employee termination expenses in the first quarter of the current fiscal year.

Juniper Networks, Inc. (NYSE:JNPR) also decided to stop the development of its application delivery controller technology licenses in July 2012. The company said its decision will result in a non-cash intangible asset impairment charge of about $85 million in the first quarter of this year. In addition, the computer networking company expects to record other non-cash asset write-downs of around $10 million.

Furthermore, Juniper Networks, Inc. (NYSE:JNPR) plans to consolidate its facilities, which will result the disposal of approximately 300,000 square feet of leased facilities in the future. The company estimated that it will incur about $70 million aggregate charges related to its facilities restructuring starting in the second quarter of this year. The company added that it might incur additional restructuring charges of around $20 million on the latter part of 2014.

Jason Noah Ader, an analyst at William Blair & Co. opined that the workforce reduction will diminish internal bureaucracy within Juniper Networks, Inc. (NYSE:JNPR). Ader said,“It’s long overdue; this is a company that has been pretty badly mismanaged. It’s bloated and there are too many people reporting to too many other people and it needed to be streamlined and rationalized.”

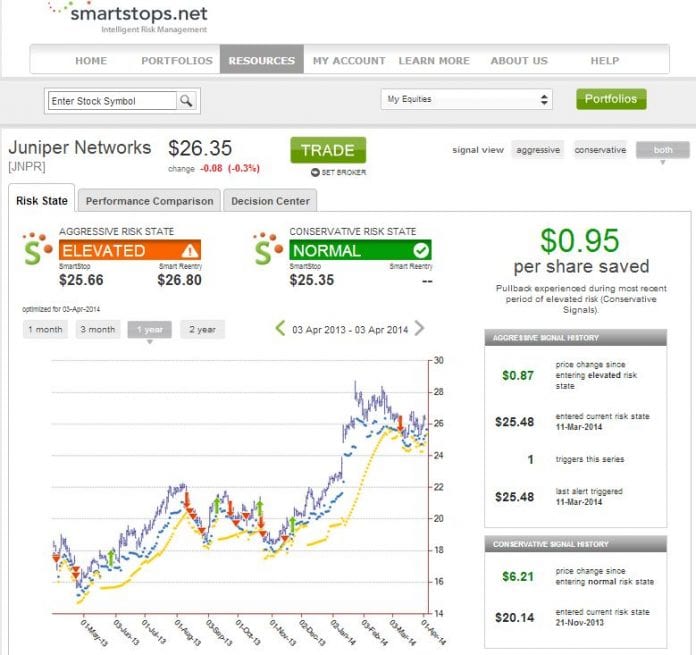

The stock price of Juniper Networks, Inc. (NYSE:JNPR) closed at $26.35 per share, down by 0.30%. The stock declined further to $26.05 per share after hours due on reports regarding its job cuts. Smartstops.net, an equity risk management firm shows the the shares of the company are currently at an elevated risk state (aggressive). The firm sent risk alert to investors who own the stock when it first entered its current risk state on March 11.