A few weeks back, we examined the retail sectors’ underperformance during the holiday season. Everyone from Big Box retailers to little niche shops were getting killed compared to estimates, as the holiday season came in shorter than usual, economic hardships and uncertainty led consumers to spend more wisely. One such stock that we analyzed was GameStop Corp. (NYSE:GME). Down 24% year to date in 2014, we are starting to see some bullish calls on the stock, led by the company’s move into new businesses, cheaper valuation, and new consoles.

These bullish calls come despite the fact that Sony Corporation (ADR) (NYSE:SNE) and Microsoft Corporation (NASDAQ:MSFT) both recently released their new, highly anticipated PlayStation 4 and Xbox One. Yet, we have seen an overall industry shift in the demand of consumers. With new consoles costing up to $500, the average consumer is sticking to alternative sources for gaming: smartphones and tablets. This shift in demand has caused GameStop to see its revenue gradually fall from around $9.3 billion to its current $8.917 billion, amid high competition.

To address this fall and remain relevant within the industry, the gaming retailer must turn to other sources of revenue and enter new markets. According to Trefis, used video game sales make up the largest component of the stock price at 37% and new gaming consoles make up the smallest impact at 3.3% of the stock price. This unfortunately shows that the retailer is relying on used game sales for the majority of its revenue and with console sales coming in below estimates, these losses must be made up somehow or face downside price action.

Recently, however, GameStop has acquired a national AT&T Inc. (NYSE:T) dealer called Spring Mobile. Through this acquisition, GameStop will continue to step up its exposure to the mobile phone industry. For instance, the company now offers various Android smartphones, including the Samsung Galaxy S3 and S4 among others. However, the company is using sales tactics such as a generous return policy and price slashing to help draw people into purchasing their phones at their local GameStop.

Wall Street, however, is giving mixed reviews. Longbow Research recently came out and downgraded the stock from a “neutral” to “underperform”. Additionally, Benchmark Co. downgraded their target price on the stock from $38.55 to $31.73. BB&T Corporation (NYSE:BBT) also cut price target outlook from $65 to $55 and Zachs Research reiterated its “neutral” rating on the gaming retailer.

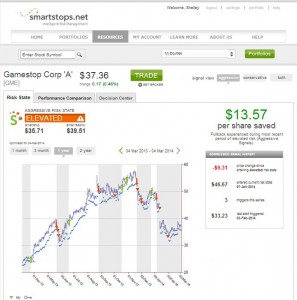

At this point, with the stock down almost 24% for the year, some investors are beginning to wonder if the pullback is a buying opportunity and whether or not the stock is undervalued or fairly valued. Those who followed SmartStops Risk Alerts wisely moved to the sidelines back in December 2013, when the shares were trading at $53, thus saving over $15 a share. For those who feel that GameStop’s moves into supporting other devices may present a good buying opportunity, just be sure that risk is being monitored continually if the premise does not play out.

Source: SmartStops

In the end, it appears despite recent acquisitions and movements into new revenue sources, Wall Street is not impressed and continues to lower estimates on the stock. Bargain hunters disagree and believe that the 24% fall in the stock this year presents a buying opportunity. Despite which side you may find yourself, GameStop still has some work to be done in its “hedging” of its traditional business model.