As the earnings season continues along, another big name announces a revenue target miss. This time, International Business Machines Corp. (NYSE:IBM) falls victim as the company continues to struggle meeting analysts’ estimates. This miss marks the fourth consecutive revenue miss and is leading investors to question the company’s direction and current strategy. While IBM reported earnings per share on adjusted results of $6.13, beating analyst estimates of $5.99 per share, revenue was off 5%. The tech giant said revenue came in at $27.7 billion compared to analysts who were expecting revenue to be $28.25 billion. Digging deeper into the earnings release it can be seen that the company’s server and storage business saw a 26.1% drop in revenue, while its largest business segment, global technology services, fell 3.6%. The only real positive the company saw from this report was a 2.8% growth in its software business revenue, however it was not enough to offset losses from its other businesses.

It is no secret that IBM is trying to move into “higher margin businesses” such as cloud computing and software, the company’s exposure to emerging markets has proved to be a struggle. Emerging market economies are still in recovery mode, which is to be expected since the developed world economies are only just recently seeing very convincing signs of economic recovery. One source of evidence is IBM’s desire to sell off its lower end server business, as reported yesterday. Initially, it appeared Lenovo Group Limited (ADR) (OTCMKTS:LNVGY) was in talks to possibly be a buyer, however no formal agreement has been made yet. However, while this business is not considered to be “high margin”, 24/7 Wall St reports that the low end server business is growing and this sale could aid IBM’s top server competitors Dell Inc. (NASDAQ:DELL) and Hewlett-Packard Company (NYSE:HPQ). Additionally, with businesses slowing spending on servers and cloud services, all three companies will continue struggling with earnings.

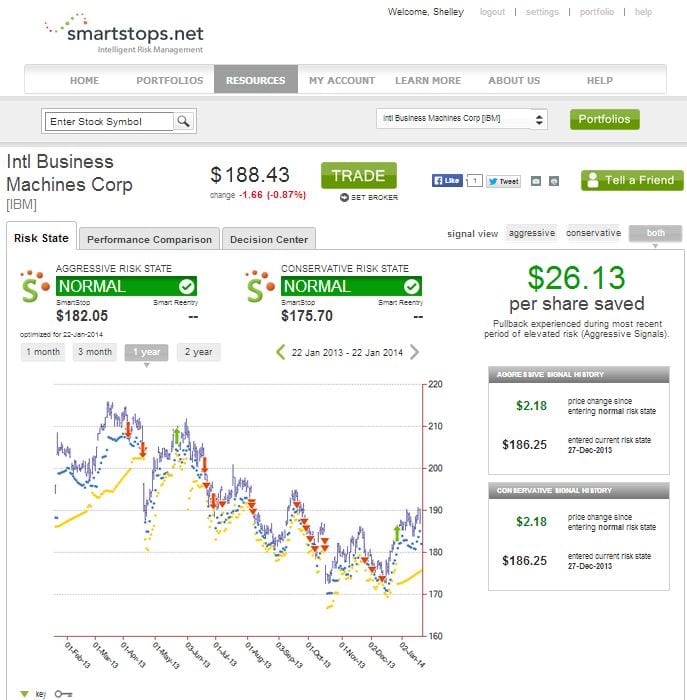

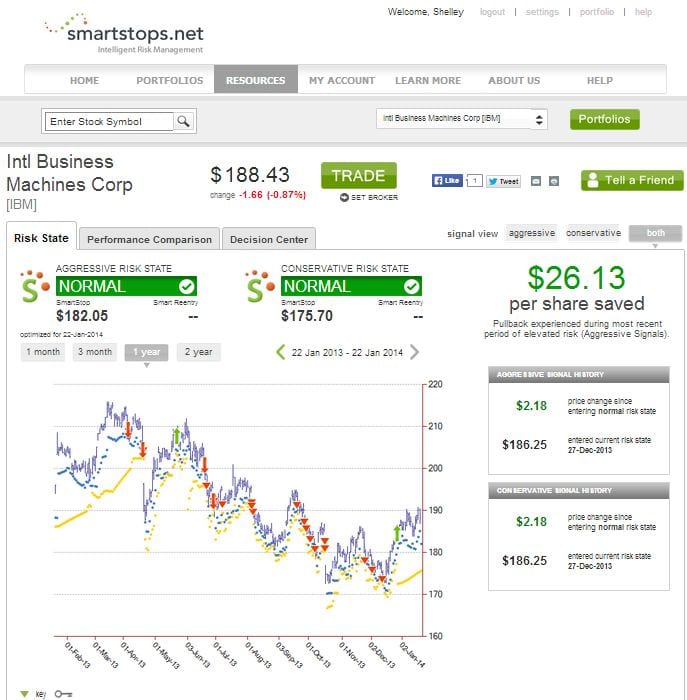

SmartStops.net, a service dedicated to aiding investors in limiting losses through the use of carefully planned stops during periods of elevated risk, gives IBM a normal risk rating currently and with IBM’s last downturn, saved investors $26.13 per share during an elevated risk period. Sidestepping risk and the ensuing downturn in a share’s price can deliver a much higher return. After a rough 2013 for IBM with elevated risk throughout most of the year, SmartStops said the stock entered a period of normal risk on December 27, 2013 and has since gained $2.18 per share.

Source: http://www.smartstops.net/PublicPages/EquityView.aspx?symbol=IB

In the end, IBM still has a difficult road ahead as businesses continue to hoard cash and hold off on server upgrades. Management must determine how to lower its risk exposure to emerging markets, as well, as it is having a lagging effect on earnings. However, as the economy continues to recover and businesses gain much more confidence in their fiscal outlook, business is likely to pick up for IBM.