Ginni Rometty, chairman and chief executive officer of International Business Machines Corp. (NYSE:IBM) acknowledged that the company failed to meet expectations last year, and it must address the challenges faced by its hardware business.

2013 Performance

In her annual letter to shareholders, Rometty said International Business Machines Corp. (NYSE:IBM) delivered $16.28 earnings per share and $18 billion operating net income, an increase of 2%. She noted that its EPS grew over the past 11 consecutive years.

Rometty also emphasized that the company returned $17.9 billion to its shareholders including $13.9 billion through share repurchases and $4.1 billion in the form of dividends in 2013. She noted that the IBM’s dividend payment increased 12% last year.

Last year, International Business Machines Corp. (NYSE:IBM) posted an 8% decline in pre-tax operating income and $99.8 billion revenue, down by 5%.

Rometty said, “We must acknowledge that while 2013 was an important year of transformation, our performance did not meet our expectations. While we continue to remix to higher value, we must also address those parts of the business that are holding us back. We have two specific challenges, and we are taking steps to address both.”

International Business Machines Corp. (NYSE:IBM) experienced challenges amid the technological shift to cloud where customers opted to store data and information online. The shift in cloud resulted to the decline in demand for hardware and weak sales in growth markets.

In order to meet the target earnings of the company, Rometty was compelled to furlough and fire employees, repurchase shares, and sell assets such as its Intel-based x86 server business to Lenovo Group Ltd (ADR) (OTCMKTS:LNVGY).

Shift to new realities and opportunities

Rometty said International Business Machines Corp. (NYSE:IBM) needs to shift its hardware business for new realities and opportunities. The company is speeding up the move of its Systems product portfolio particularly its Power and Storage to growth opportunities and to Linux.

“The modern demands of Big Data, cloud and mobile require enterprise-strength computing, and no other company can match IBM’s ongoing capabilities and commitment to developing those essential technologies,” according to Rometty.She maintained the $20 earnings per share target of International Business Machines Corp (NYSE:IBM) by 2015.

Equity risk

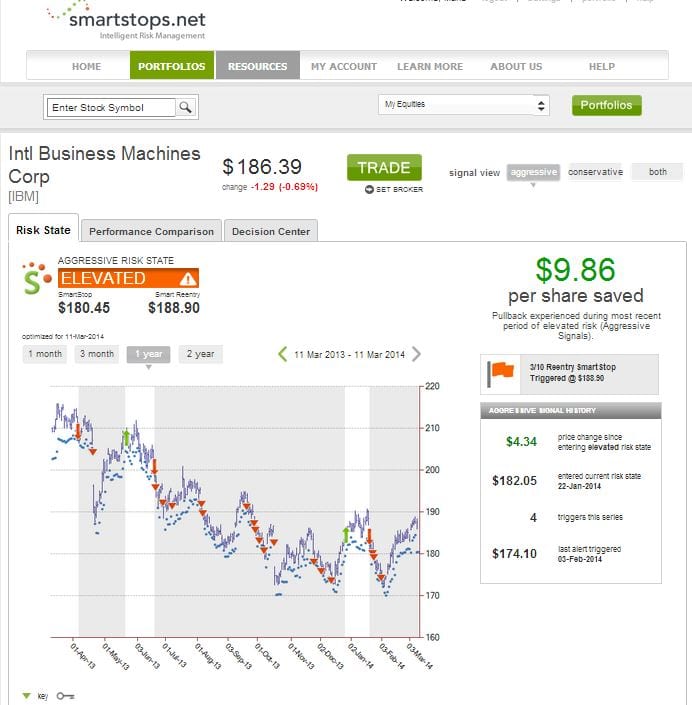

The shares of the company closed at $186.39 per share, down by nearly 1% on Monday. Smartstops.net, a stock market risk management firm shows that the stock of International Business Machines Corp. (NYSE:IBM) is currently under elevated risk. It entered its current risk state when it traded around $182 per share on January 22. Investors who pulled back their investment in the company after receiving alert from Smartstops.net saved $9.86 per share as illustrated above: