Income taxes are government charges made towards individuals or organizations based on their earnings or revenues. Tax rates multiplied by taxable income are typically used to calculate income taxes governments receive funding from income taxes, which are employed to finance government obligations, pay for public services, and supply citizens with goods.

Numerous states and municipal governments also demand payment of income tax, in addition to the federal government. The percentage of your income subject to taxation is determined by your filing status and annual income. Theoretically, your expenses increase as your income does.

Calculating income tax is a difficult task. Most often, just raising income tax makes people anxious, especially those who are salaried and with no prior experience with taxes. Calculating income taxes, however, need not be that challenging. Many websites today offer a quick and straightforward way to determine how much tax a person owes. You can visit tax calculator Alberta to view the payable for each Canadian province and territory by entering your income from employment, eligible and ineligible dividends, capital gains, and other income. Additionally, the calculator will show the average and marginal tax rates.

But without the correct information, it is evident that you will wind up paying either more or less tax than you should. For this reason, you should be familiar with the jargon and the suitable methods for figuring out how much income tax you should be paying. The majority of people refrain from filing taxes because they lack knowledge. So here is a step-by-step guide for how to estimate your income tax precisely.

Step1- Income Details

Write down your annual gross income first. It will cover every aspect of your pay, including the House Rent Allowance (HRA), the Leave Travel Allowance (LTA), and any additional unique benefits, such as food vouchers and cell phone reimbursements.

The two main exemptions you are granted are House Rent Allowance (HRA) and Leave Travel Allowance (LTA). Remember that you may only claim HRA if you are renting your home and can provide evidence in the form of a genuine rent receipt, but it is taxable if you rent an apartment on your own or live with your parents.

Step2- VIA Deduction

A taxpayer may subtract certain expenses, allowed expenditures, charitable contributions, and other items from their income under Sections 80C, 80CCC, 80CCD, 80CCE, 80D to 80U of the Income Tax Act, and deductions may be claimed.

It comprises all assumptions, including investments in mutual funds, life insurance policies, interest on savings, PPF, NSC, SIPs, returns on mutual funds, home loans, and more. The purpose of the deductions allowed by Chapter VIA is to lessen the taxpayer’s tax liability.

Taxable Income = Gross Income – Deductions

Note-A taxpayer’s total deductions cannot be greater than their entire gross income.

Step3- Determine Your Tax Slab

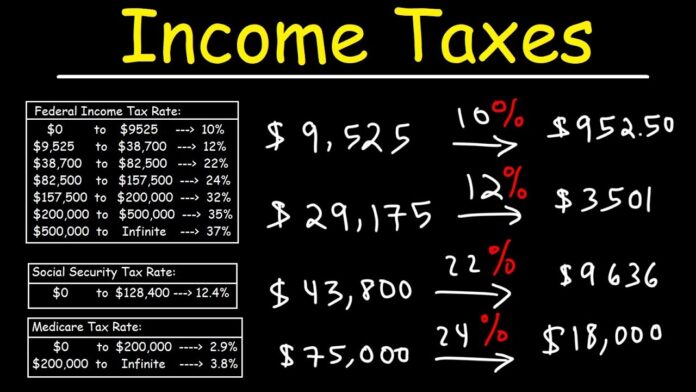

You can determine the total income on which you must pay tax based on your tax slab by deducting all allowable deductions from your gross taxable income. In a slab system, various income levels are subject to varying tax rates. It indicates that when a taxpayer’s income rises, so do their tax rates.

This taxation helps the nation have progressive and equitable tax systems. These income tax slabs frequently vary with each budget.

Step4- Calculate Tax After Considering TDS

The TDS idea was introduced to collect tax from the revenue source. After deducting TDS, the person or business must deposit the money with the federal government.

The Income Tax Act stipulates that TDS must be withdrawn when making certain payments, which applies to everyone. However, if the payer is an individual or HUF whose books are exempt from audit, no TDS must be subtracted.

Advantages Of Paying Income Tax

- Loan authorizations: Major banks may ask for a copy of your income tax returns when you apply for a loan, particularly for a home loan, a car loan, etc. Banks use your salary to determine if you can afford the loan.

- Visa requests: When you apply for a visa, many foreign consulates ask you to file tax returns from the preceding years. This is because income tax returns indicate that you are not attempting to escape taxes by leaving the country.

- Government contract: When applying for any public contracts, Income tax return receipts may occasionally be required. However, this depends on the specific government agency, and no burdensome regulations are in place. This ensures that you are financially stable and can meet your debts.

- Compensation: To receive payment in a car accident that leaves a person disabled or accidentally dead, self-employed people may need to provide Income tax return receipts. This is because the person’s income must first be determined to determine the proper reimbursement.

- Refund claims: Only filed income tax returns are eligible to submit refund claims for any money owed to them by the IT Department. If ITRs are introduced, it may be possible to collect refunds from specific savings instruments even if income is below the tax exemption threshold. One illustration is fixed deposits, with a 10% tax withheld at source.

Penalty On Not Paying Taxes

A taxpayer must file an income tax return as soon as possible as indecisiveness in payment can increase the punishment and potential prison sentence increase with the period you go without filing your taxes. You must file right away whether you are one year, five years, or even ten years late.

Bottom-Line

Everybody wants to live a lavish life but believes it is impractical because a sizable portion of their income is used to pay taxes. Thus, at the start of the assessment year, you must correctly declare all your investments to compute all the tax due. Knowledge of taxes, deductions, and returns is crucial for laying a solid financial basis. Legal offenses include making incorrect tax payments, giving inaccurate information, and lying. Knowing the correct computations and deductions can help with tax planning and money management, leading to the opulent lifestyle everyone aspires to. Furthermore, it prevents tax fraud from occurring.