Short term loans, also known as payday loans are usually used by people who have financial emergencies. Now, you might be wondering – why for emergencies only? Well, there is a high-interest rate connected to them. Individuals who already took out one payday credit can, in fact, take out an additional one.

If you are thinking about taking out an additional one, there are some things that you should know and consider first. The article below is going to explain what they are, how you can get them, as well as whether or not you should take out multiple ones. Let’s take a closer look at the list:

So, What is it And How Does it Work?

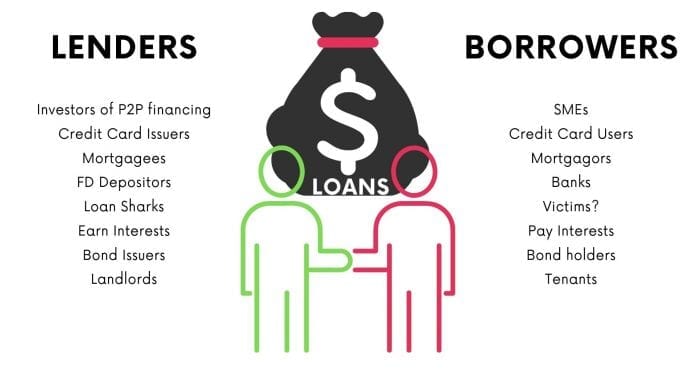

To put it simply, payday loans are short term advances that were created with the purpose of helping people until they receive their paycheck. The money you get from the lender will be deposited directly to your banking account, and at the end of the month, you’ll need to pay the money back – with full interest rates and sometimes, additional charges.

You can also choose to borrow for a longer period of time – usually around three months – and repay the money in monthly payments. No matter whether you take out one for a month or three, there is something that connects all of them, they are short-term and they come with a high-cost.

As mentioned, you’ll need to wait until your payday to give the money back, but, depending on the provider you chose, some companies might allow you to choose the repayment period, especially if you borrowed a higher amount. When thinking about taking an additional one, you should first think long and hard whether or not you can actually afford to pay it back.

Can I Take Out Multiple Ones?

Yes, you can take out more than one loan. Some companies even allow you to take out four at the same time, however, this is not advised. You’ll also need to meet some requirements, that will be more strict than when you took out the first one. Now, you should know that it is not the lender who implemented this criterion, it is the ASIC requirement for the borrower.

This happens because these credits were meant for financial emergencies only, instead of being a long-term solution to financial issues, hence, getting an additional loan is a clear sign that an individual might be struggling economically. Since you might already be paying back the first one, the lender needs to take additional measures to make sure that you can pay the money back.

So, What Are The Requirements?

Of course, there is a wide range of requirements imposed by ASIC, implemented to protect both the lender and borrower. The lending companies will take things even further and will ensure that the lender does not have difficulties with making payments if any of the listed situations apply:

- If you are repaying your first payday mortgage at the moment.

- If you have missed a payment that is due.

- If you took out 2 or more short-term advances in the last three months.

- If you plan on using the loan in order to repay a prior one.

In order to follow the aforementioned regulations, the lending companies must ensure that their applicants can actually pay them back without meeting additional difficulties. This means that they’ll likely review your current economic situation, and look at several things that can influence your repayments.

The things they will look at include your credit history, how much of the current one you have paid back, whether you received any Centrelink payments, as well as your employment history and income. If you are interested in seeing information about taking out loans with bad credit, check out bellwethercap.com.

How Can I Get Approved?

The very first thing that is worth mentioning is that there is no way to secure a second or third short-term mortgage. And, getting approved for a second one might be even harder than when you applied for the firs tone. When applying, you should carefully consider several things including:

- Look at Some Alternatives – there is a wide range of no or low-interest mortgages that you can opt for, however, this might mean that you’ll need to wait a little longer for the approval and funds. If you do not need the funds right away, you can choose an alternative one.

- Check Whether or Not You Meet The Requirements – as mentioned, there is no way of you knowing if you’ll be approved, hence, it is wiser if you do not assume anything. Some companies might specify that an individual cannot repay them or that they cannot use a second one for paying off the first, hence, you should check all the requirements to avoid being rejected.

- Always Check Your Financial Situation – when applying, you should think about your monthly budget, including all of your expenses, monthly payments, and so on. If you see that you’ll be left with nothing once you pay for everything, it might be wiser to choose an alternative option.

- Always Compare Multiple Companies – if you have one already, you can choose to apply for an additional one with a different company. Hence, once you are doing some research, always compare the prices, packages, interest rates, and charges. This will help you determine what option might be better for you.

- Read The Reviews – another thing that can help you narrow down your list of potential candidates is to read the reviews. Of course, the first place you’ll head to is their official website, however, you should also check independent ones. The reviews there are usually more honest, which means that you’ll get a real picture of the lending company.

Conclusion

As you can see, it is possible to take out more than one payday loan. However, before you chose to do this, you should think carefully and wisely about whether or not you can actually manage to repay it. So, now that you know how you can get an additional short-term loan, do not waste any more time. Instead, go back to the requirements section and see if you can take out an extra loan.