As the US markets continue to whipsaw, investors continue to worry about a looming correction. One major argument that a correction is around the corner is that earnings are beginning to slump. Across the board, we have seen big names such as Wal-Mart Stores, Inc. (NYSE:WMT) and Chevron Corporation (NYSE:CVX) miss analyst estimates, just to name a few. Today, Amazon.com, Inc. (NASDAQ:AMZN) joins the group of companies that have missed their earnings estimates.

The e-commerce retailer reported fourth quarter earnings per share of $0.51 on revenue of $25.59 billion. Analysts were expecting earnings per share of $.66 on revenue of $26.06 billion. The earnings and revenue miss from Amazon sent shares down over 10% for the day, and certainly Wall Street is showing concern of the company’s direction moving forward.

Unfortunately, as we have continued to see, consumers are becoming more frugal with their money and search for deals to preserve cash. Intense competition from competitors such as eBay Inc (NASDAQ:EBAY), storefront retailers Target Corporation (NYSE:TGT) and Wal-Mart Stores, Inc. (NYSE:WMT) are eating away at Amazon’s margins, particularly its profit margin and operating margin. That being said, Amazon has released a few new strategic plans that will hopefully keep its earnings growth in the double digits. The company is continuing to see growth in its cloud computing business, as well as its Amazon Prime Instant Video service, a rival to Netflix, Inc. (NASDAQ:NFLX)’s business. Additionally, Amazon CFO Tom Szkutak said the company was looking to raise the price of its Amazon Prime Service by $20. The current number of Prime subscribers comes in at 20 million. Lastly, the company has also said to be working on a PayPal competitor that would allow users to make mobile payments, which is a $278.9 billion industry. However, in the meantime, Amazon must continue to position itself competitively in an increasingly competitive retail industry. Certainly its long term growth aspects appear bright, but according to Achilles Research, “The current valuation multiples, both in terms of earnings and free cash flow, are clearly not sustainable and investors need to be aware that an investment in Amazon is of high risk. If Amazon disappoints in the coming quarters, the share price could react extraordinarily sensitively”.

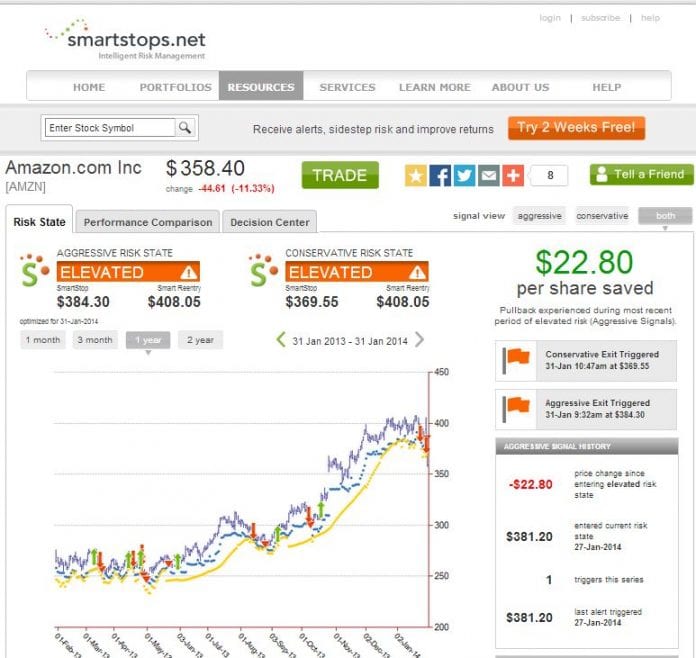

This is why investors must remain vigilant and carefully monitor their positions in Amazon. This is where risk management services such as SmartStops.net comes in. SmartStops alerts investors when a stock has entered a period of normal or elevated risk, giving the investor an opportunity to protect their profits or avoid steep losses like we saw today.

SmartStops first alerted investors on January 27, 2014 that Amazon had faced an elevated risk state when it was then trading at $381.20. With today’s major pitfall in Amazon, SmartStops issued a second alert advising investors of elevated risk at 9:32am on January 31, 2014, when the stock was still trading at $384.30. Investors that chose to exit or hedge their Amazon positions this morning when the alert was released would have saved $23.84 per share in potential losses.

Source: SmartStops

The bottom line here is that Amazon does have long term plans that will help aid double-digit growth. Its plans to enter the mobile payment business and its continued growth in the cloud computing business will certainly be big drivers moving forward. However, as Achilles Research stated, the stock is still trading at inflated levels and really has less room for error in its next few earnings releases. Another release like today could trigger a similar drop in the stock and investors must be prepare themselves to avoid losses.