Herbalife Ltd. (NYSE:HLF) reported first quarter earnings results that outperformed the consensus estimate of Wall Street analysts despite ongoing regulatory investigations in connection with allegations that it is operating a pyramid scheme.

The seller of nutrition and weight loss products announced that its board of directors stopped its quarterly dividend, but accelerated its stock buyback. Herbalife Ltd. (NYSE:HLF) also raised its earnings guidance for 2014. Its stock price closed $58.85 per share, up by 1.76% on Monday, but dropped 0.70% to $58.44 after hours.

Financial results

Herbalife Ltd. (NYSE:HLF) earned $74.6 million or $0.74 earnings per diluted share for the first quarter compared with $118.9 million or $1.10 per diluted share in the year-ago quarter. The earnings of the company were lower mainly because of a foreign exchange loss Venezuela during the period.

Excluding the one item event, the company said its earnings were $151.1 million or $1.50 per diluted share, higher than the $1.30 per diluted share estimated by analysts.

During the three month period, Herbalife Ltd. (NYSE:HLF) generated $190.6 million free cash flow, and invested $49.7 million in capital expenditures. The company returned capital to investors in the form of quarterly dividend worth $30.4 million and repurchased 9.9 million outstanding common shares worth approximately $685.8 million.

In a statement, Michael Johnson, chairman and CEO of Herbalife Ltd. (NYSE:HLF) said, “We continue to achieve record earnings, strong sales growth and enhanced profitability. Our performance reflects the demand for our exceptional products, as well as the hard work of our independent members who continue to cultivate and grow their base of satisfied customers worldwide.

Board of directors eliminate quarterly dividend

The board of directors of the company eliminated its quarterly dividend to accelerate its initiative to return cash to shareholders through stock buyback in the second quarter.

Herbalife Ltd. (NYSE:HLF) said it will repurchase additional shares worth $581 million next quarter as part of its previously announced $1.5 billion shares buyback program.

According to the company, the $581 million include $315 million worth of shares under its 10b5-1 trading plan ($225 million completed last April 25), additional $50 million included in the previous guidance, and $216 million expected to be returned to shareholders over the next eight quarters supposedly in the form of cash dividends.

“Our strong sustained financial performance and the current market valuation of our shares make repurchasing stock the most attractive method of returning capital to shareholders and reflects our continued commitment to creating long-term value for our shareholders,” said Johnson.

Earnings outlook

For the June quarter, Herbalife Ltd (NYSE:HLF) expected to deliver earnings per share in the range of $1.51 to $1.55 per share. For the full year 2014, the company estimated to deliver earnings in between $6.10 and $6.30 per share.

Equity risk

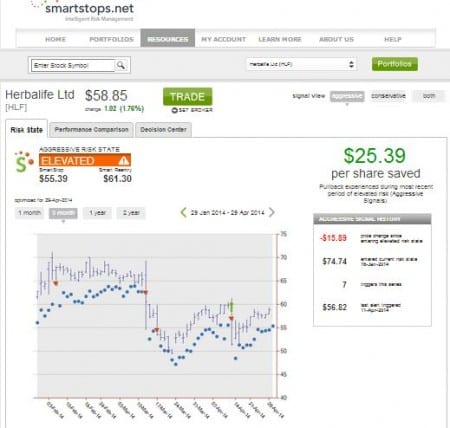

The stock price of Herbalife Ltd. (NYSE:HLF) declined more than 26% year-to-date, according to data from Yahoo! Finance. Equity risk management firm, Smartstops.net shows that the shares of the company remained at an elevated risk since January 16. Investors who exited their position from the stock at time when it entered its current risk state saved $25.39 per share.

The firm’s risk management algorithms are a product of more than 40 years of stock market experience. Its solutions help investors to make wise decisions in trading and protecting their stock investments against huge losses.