The stock price of Herbalife Ltd. (NYSE:HLF), the multilevel marketing company that sells nutritional and weight loss products plummeted nearly 14% to $51.48 per share on report that the United States Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI) launched a criminal probe against it.

Herbalife Ltd. (NYSE:HLF) has been accused of operating a pyramid scheme by Bill Ackman, hedge fund manager of Pershing Square Capital Management and a number of Latino civil rights organizations.

According to Bloomberg, federal authorities are investigating the marketing practices of the company based information from sources familiar with the inquiry. The report regarding the federal criminal probe was first reported by the Financial Times.

Herbalife says no knowledge of criminal probe

Herbalife Ltd. (NYSE:HLF) issued a statement that it has no knowledge regarding the report that federal authorities are conducting a criminal probe against it. The MLM company said,” We have no knowledge of any ongoing investigation by the DOJ or the FBI, and we have not received any formal nor informal request for information from either agency.”

“We take our public disclosure obligations very seriously. Herbalife does not intend to make any additional comments regarding this matter unless and until there are material developments,” added Herbalife Ltd. (NYSE:HLF).

FTC investigation

The Federal Trade Commission (FTC) has an ongoing civil investigation regarding the complaints against Herbalife Ltd. (NYSE:HLF). The agency launched its inquiry on the business practices of the company amid calls not only from Ackman, Latino civil rights groups, but also from lawmakers particularly from Democratic Senator Edward Markey of Massachusetts.

Herbelife Ltd. (NYSE:HLF) welcomed the investigation of the FTC and said it will “cooperate fully” with the regulator.

Earlier this week, Meredith Adler, an analyst at Barclays Equity Research reported that the potential outcome of the FTC investigation may be a consent decree wherein the company will be compelled to change its business strategy and pay a penalty based on her interview with Atty. Kevin Thompson who specializes on cases involving MLM companies.

The report also indicated a lawsuit as a potential outcome of the FTC investigation, but Atty. Thompson opined that it is unlikely. “I just don’t see them [referring to FTC] going after a public company like Herbalife. I don’t see why the FTC would want to sue these guys. And I’m really careful when I say that. I am not a naïve person. And when it comes to the government, you can’t really predict what they’re going to do. But there are so many companies that are better target than Herbalife. A suit just doesn’t make sense to me.”

The lawyer opined that the regular has the option to immediate file a lawsuit against Herbalife Ltd. (NYSE:HLD), but chose to conduct an investigation. According to him, the action of the regulator suggests that the agency did not have enough evidence to win a lawsuit under the existing law.

Equity risk alert

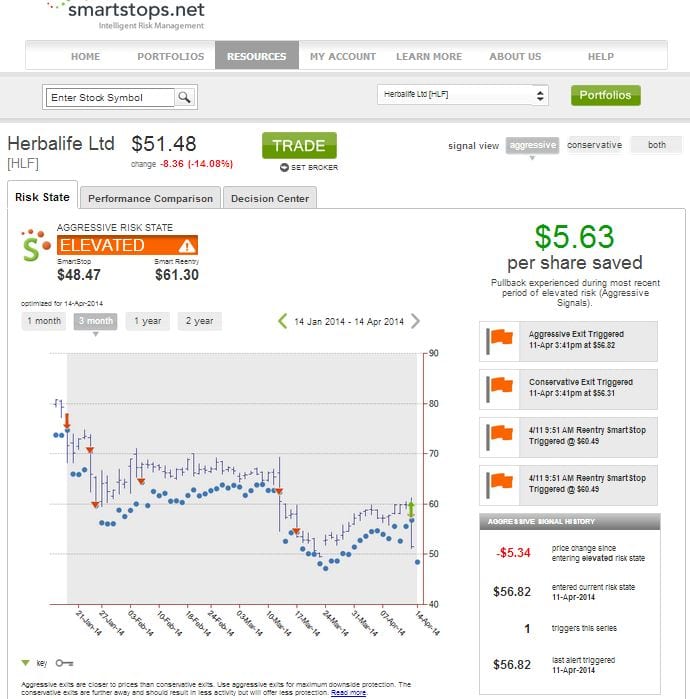

Smartstops.net, a stock market risk management firm shows that the shares of Herbalife Ltd. (NYSE:HLF) continued to stay at an elevated risk state. Investors who exited their investment in the stock when they received a risk alert from the firm when it first entered its current elevated risk state saved $20.50 per share.

The risk management algorithms of Smartstops.net are a product of more than 40 years of stock market experience. Its proprietary analysis produces a risk price point, which can be used proactively by investors in the next day’s trading. The firm’s service also alerts investors in real-time to an “elevated” risk state indicating a high probability of a continued decline in the equity’s price.