When you think of Google Inc (NASDAQ:GOOG), the first thing that comes to mind is usually the Google search engine, their staple and what the company has built itself up around. However, over the past several years, the tech giant has began to move in other areas in seek of domination. One of the most important acquisitions Google has made in order to be in a better position in the smartphone market was its purchase of Motorola for $13 billion. This purchase helped Google strengthen its Android smartphone operating system and has since taken a nice chunk of market share from sworn rival Apple Inc. (NASDAQ:AAPL). According to Trefis, the “Google Phone and Motorola” business makes up 2.3% of Google’s share price. This is compared to its top revenue source, “Google PC Search Ads”, which account for almost 37% of the share price. As you can see, Google may be working on big items behind the scenes such as an upgraded iPhone competitor, contact lenses that can measure insulin levels for diabetics, glasses that can surf the web, and more; but it stays true to its roots of ads and so far the strategy has worked out very well.

Google’s latest acquisition was quite a head-scratcher for investors. The tech giant spent $3.2 billion to purchase Nest Labs, a company that makes thermostats and smoke detectors. When I mention that this is the second largest acquisition in company history behind Motorola, you may be wondering how smoke detectors are the company’s new target. To be sure, it is no secret the company would love to have a larger presence in the everyday household, beyond the computer.

Taking a deeper look into what Nest Labs is all about, you will find the company is not making your everyday thermostats and smoke alarms. The company has added a “smart” component that learns users habits overtime and through algorithm communication, the thermostat can use human behavior to determine what the correct temperature is needed. This is all part of the latest new emerging trend of machine learning and adaptation to help make our lives easier. Google is at the head of this revolution and as Benedict Evans, a technology analyst, put it: “Google is a vast machine-learning project that has been running for over a decade. The objective of Google is to get more data into that system”. A more comical comparison could be to the movie “Her”, which features a man falling in love with a computer that is able to feel and communicate. However, this situation is much more preferable than Will Smith’s “iRobot” in which robots that were designed to help make human tasks easier, rise up and fight back.

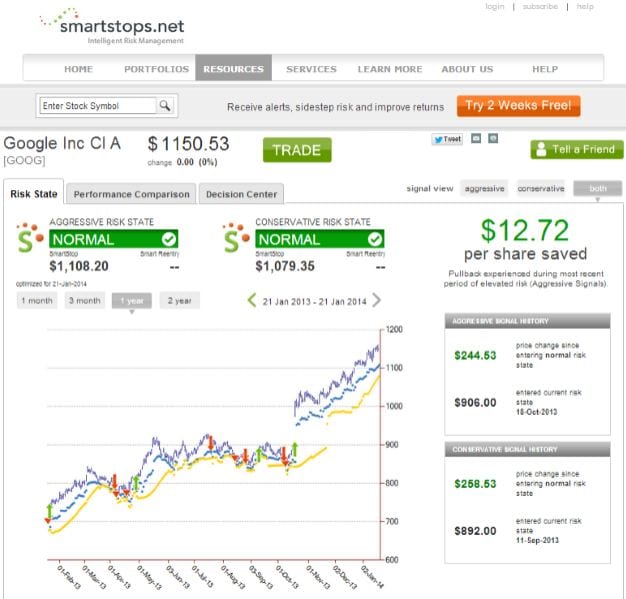

According to SmartStops.net, a service dedicated to help protecting investors from downside risk, Google is listed as a normal risk rating and has been in that state since October 18, 2013. Since then, the stock has experienced an upside of $244.53, when looking at the aggressive signals. Additionally, the service has saved investors $12.72 per share in times of elevated risk, when looing at aggressive signals. A chart below demonstrates the levels of stops and buying opportunities.

Source: http://www.smartstops.net/PublicPages/EquityView.aspx?symbol=GOOG

Overall, Google is on a great path and is certainly continuing to add many very futuristic projects that could soon one day become staples in our daily lives. Not to mention, significantly make our appliances and everyday necessities such as contact lenses, able to save lives.