At the turn of the new millennium, the video game retailer GameStop Corp. (NYSE:GME) began to take shape into the store that we know today. The retailer was at the head of the console gaming revolution with then rival EBGames (GameStop acquired EBGames in 2005) by offering up a new concept: used games. This allowed gamers to purchase their favorite releases without paying up full price. This gave the retailer an advantage over other gaming retailers such as Best Buy Co., Inc. (NYSE:BBY), Target Corporation (NYSE:TGT), and even Wal-Mart Stores, Inc. (NYSE:WMT).

Now in 2014, the much anticipated Sony Corporation (ADR) (NYSE:SNE) PlayStation 4 and Microsoft Corporation (NASDAQ:MSFT) Xbox One are finally in stores, just in time for the 2013 holiday season. Investors certainly know that the release gap between the previous consoles and the new consoles hurt GameStop significantly on their bottom line as the older consoles lost their luster. So, did GameStop have a successful holiday season? Not according to its 4th quarter earnings release that just came out. While GameStop did post an uptick of 10% for same store sales, 4th quarter profits came in at $1.95 a share and analysts polled were estimating around $2.14 per share. In addition, the gaming retailer is expecting revised lower full year profit of $2.96 per share to $3.06 per share, compared to Wall Street estimates of $3.25.

How can this possible, you may be thinking? GameStop came out on January 7th and said they had sold 4.2 million PlayStation 4 consoles and 3 million Xbox One consoles. However, as we heard from GameStop CFO, Rob Lloyd, hardware sales (consoles) led to lower profit margins, while game sales slumped 23%.

Unfortunately for GameStop Corp. (GME), the down economy and the rise of smartphones and tablets are the “behind the scenes” kryptonite. As consumers find their financial situations more strapped than previously before 2008, the appeal for $60 games and $500 consoles is a pricey luxury. In addition, Apple Inc. (NASDAQ:AAPL)’s app store and Google Inc (NASDAQ:GOOG)’s Play app store have allowed consumers to turn their smartphones and tablets into the next gaming revolution. With endless games that can be instantly downloaded for free or a meager $.99, in addition to their many other uses, consumers have found these new pieces of hardware to be the new normal.

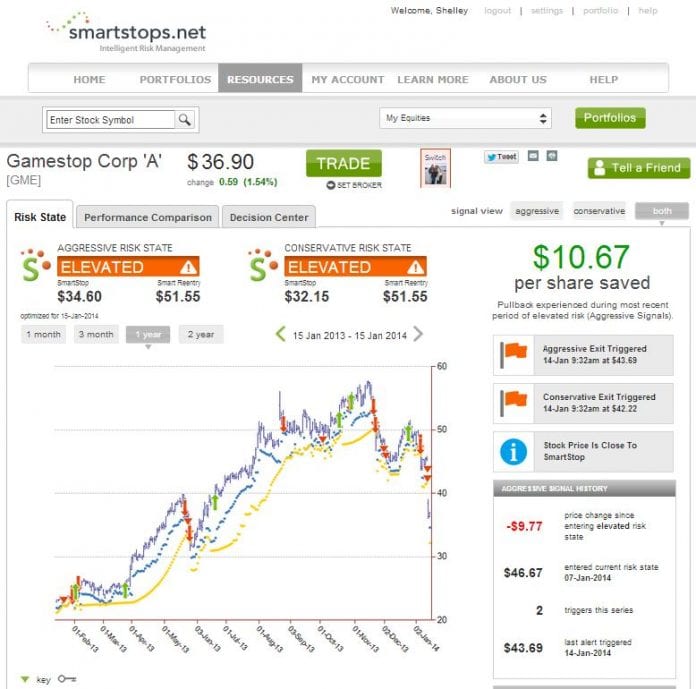

In the end, GameStop Corp. (GME) appears to be struggling more than ever, with shares down over 25% year to date already. SmartStops.net kept investors profits protected by issuing risk alert warnings.

Source: http://www.smartstops.net/PublicPages/EquityView.aspx?symbol=GME

It will certainly be an uphill battle to regain its once gaming hegemon status. Many gamers and investors alike have since called the console gaming industry a declining breed and GameStop appears to be a likely casualty, should those grim forecasts become reality.