When you live from payday to payday, it sometimes becomes extremely difficult to deal with unexpected bills. It is natural to feel concerned when you know there’s still time in your payday but you have to find money to fix up your car. Sometimes, you need to make an immediate investment into your business, and that is when you have to look for a way to arrange money quickly. You just can’t go to your bank for assistance because the process to qualify for a loan is quite tricky and lengthy. In such situations, you can use the internet and consider taking installment loans online in Canada.

While installment loans are getting quite popular in Canada, many people still have questions about the way it works and situations when you can benefit from these loans. That’s when the following information will surely help you make a better decision.

What are Installment Loans?

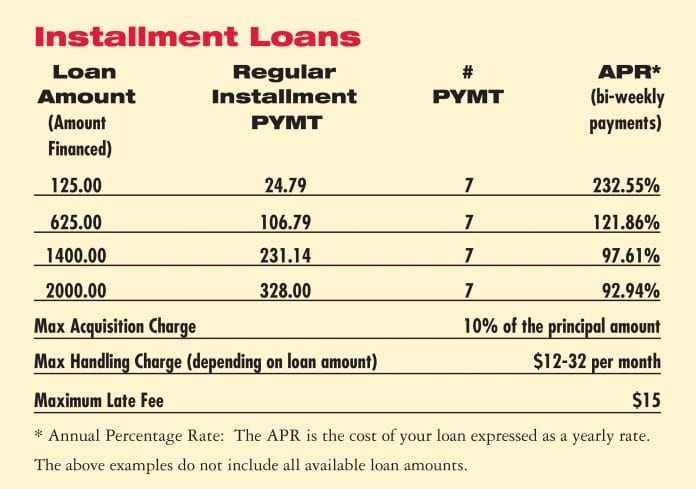

As implied by the name, you get a specific amount of money and pay it back in installments. You usually need to repay at regular money or biweekly intervals. These loans are quite similar to payday loans, which are short-term loans with high interest rates. However, the main difference is installment loans can be much larger than standard payday loans – they’re still not as large as the personal loans you get through traditional financial institutions like Friendly Lander.

The time you can take to repay your installment loan fully depends usually on the terms you agree to at the time of applying for a loan. For instance, these loans are available for short-term as well as medium-term durations. Mostly, you need to repay your loan within 6 months, but some lenders might be willing to extend the term to 5 years as well.

Depending on the terms, you may end up dealing with a high interest rate – the interest rates for installment loans are usually a lot higher than personal loans but you can still hope to get a better deal working with reputable companies.

What are the Most Common Uses of Installment Loans?

While installment loans are not as regulated as payday loans, you may still consider getting one to deal with your urgent financial needs. There is actually no limitation on how you want to utilize your funds, but most people would use the money to deal with the following emergency needs.

- To Deal with Repairs: Sometimes, home or automotive repairs can’t wait, and you can handle the situation well using an installment loan.

- To Pay Utility Bills: Not being able to pay an impending utility bill is another situation when you can resort to an installment loan. You can get it quickly because it is a type of bad credit loan and doesn’t waste time checking and rechecking your credit history.

- To Handle Medical Expenses: No matter how well you think you’re prepared with your savings, certain health problems can make you spend more than you might have anticipated. That’s when taking out an installment loan can serve as a lifeline and save you from experiencing unfortunate outcomes.

What Do You Need to Produce to Get an Installment Loan in Canada?

You don’t need to go through a lengthy process for approval and that is the biggest benefit of taking an installment loan in the first place. Nevertheless, you will need the following to be able to qualify for a loan:

- You will have to submit proof of income when applying for your installment loan. It could be anything, like your employment verification letter or even a tax slip. Many people think that you need to have a full-time job to qualify for an installment loan, but that’s not true because disability income, part-time jobs, social welfare benefits, and pension income count too.

- You will need a bank account to receive your money. Once you have your loan application approved, your lender will transfer money directly into your bank account. Keep in mind that some lenders would allow you to collect the money from a physical branch, so you may not need a bank account at all.

- You will have to provide something for age verification because there’s a minimum age limit to qualify for installment loans. A government-issued ID is all that you need here.

- You will be able to qualify for an installment loan if you’re a Canadian citizen or permanent resident. Therefore, you will have to keep relevant documents handy while applying for the loan.

What Should You Consider When Choosing a Lender?

These days, you can find a multitude of providers online to help you get an installment loan. Therefore, it is more important than ever to take some time and compare your options to select the best deal, which aligns with your urgent needs as well as financial capabilities to repay your loan.

Here are a few things to bear in mind when contemplating an installment loan:

- Consider the principal amount before finalizing your decision. It may be tempting to go for a large amount but understand that it may become difficult to repay it because of the high interest rate. Consider your budget conservatively and only take the amount you can’t manage through your income and savings.

- Consider how long you can wait to get a loan. While different lenders may work at different speeds, you’re likely to pay a higher interest for faster loans.

- Check the interest rate upfront to get an idea of how you’ll manage to repay it within the set timeframe.

- Pick the right term carefully. You may be thinking that longer loan terms are better because of lower monthly payments, but remember you will be paying more in interest charges in total. So, take into account your unique circumstances when selecting a term.

Conclusion

Installment loans are one of many bad credit loans currently available in Canada and they can surely help you stay afloat by managing your financial needs. Just be sure to do your research and know the terms before finalizing your decision.