Facebook Inc (NASDAQ:FB) traded higher today, but its stock is still at an elevated risk state, according to Smartstops.net, an equity risk management firm that provides easy-to-implement risk monitoring tools for investment professionals and individual investors to improve profits and minimize losses.

The social network giant’s stock price rose by nearly 1% to $58.89 per share today. The stock was lifted by report that Facebook Inc (NASDAQ:FB) will enter the mobile-payment market and it will be offering remittances and electronic money services on its platform.

Facebook close to receive Ireland’s approval for e-money services

According to Financial Times, the social network giant is close to receiving approval from the Central Bank of Ireland to start its e-money transfer service. The report also indicated Facebook Inc (NASDAQ:FB) engaged in partnership discussions with three startups offering online and mobile international money transfer services including TransferWise, Moni Technologies and Azimo.

The social network giant will become an e-money institution once it receives the authorization from the Central Bank of Ireland. Facebook Inc (NASDAQ:FB) will be allowed to issue units of stored monetary value that represent a claim against the company through a process called “passporting.” The e-money will be legal across the European region.

Facebook has U.S. licenses for money service business

Facebook Inc (NASDAQ:FB) already have licenses for its money service business in the United States thus, it has the ability to money remittances services of currency exchange.

Observers in the financial services market believed that the real challenge for Facebook Inc (NASDAQ:FB) is to demonstrate its ability to compete with other payment and money transfer services such as Paypal and Western Union among others. In addition, the social network giant needs to gain the trust of customers that its service is fast, reliable, and safe.

Watsa Warns of tech stock bubble

Prem Watsa, the chairman and CEO of Fairfax Financial Holdings Ltd (TSE:FFH) and famously known as the Warren Buffett of Canada recently warned of tech stock bubble particularly those so-called momentum stocks including Facebook Inc (NASDAQ:FB), Netflix, Inc (NASDAQ:NFLX), and Twitter Inc (NYSE:TWTR).

According to him, the prices of these stocks are unsustainable. He said, “There’s nothing underlying the value of these companies,” while referring to a chart showing price-to- earnings ratio (P/E Ratio). He further stated that investors who own the stock will end up in tears.

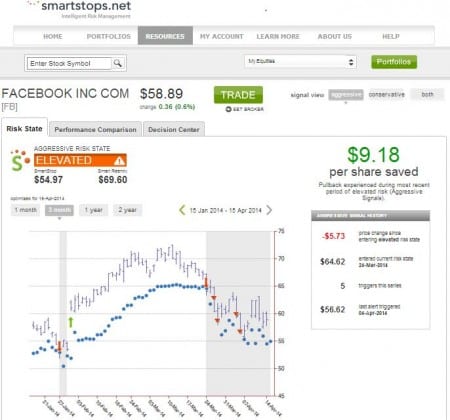

Investors who exited their investment in the shares of Facebook Inc (NASDAQ:FB) saved $9.18 per share after receiving a risk alert from Smartstops.net when it entered its current elevated risk state.

The firm issued its first aggressive exit trigger when the stock declined to $64.62 a share on March 24. It exit trigger serves as an alert to investors that there is a potential for the price of the stock to continue going downwards.