Cisco Systems, Inc (NASDAQ:CSCO) reported fiscal second quarter financial results that beat the consensus estimates of Wall Street analysts. The company also raised its quarterly dividend, but it seems investors ignore those factors since its stock price declined by more than 4% to $21.88 per share after hours.

During the quarter, Cisco Systems, Inc (NASDAQ:CSCO) delivered $0.47 Non-GAAP earnings per share, higher than $0.46 earnings per share average estimate of analysts. The company’s $11.2 billion revenue was also higher than the $11.03 billion consensus estimate.

In a statement, said John Chambers, chairman and CEO of Cisco Systems, Inc (NASDAQ:CSCO) said, “We delivered the results we expected this quarter. I’m pleased with the progress we’ve made managing through the technology transitions of cloud, mobile, security and video.”

Chambers added, “Our financials are strong and our strategy is solid. The major market transitions are networking centric and as the Internet of Everything becomes more important to business, cities and countries, Cisco is uniquely positioned to help our customers solve their biggest business problems.”

The board of directors of the company increased its quarterly dividend to $0.19 per share, an increase of 12%. The company also repurchased approximately 185 million shares of common stock with an aggregate value of $4 billion during the quarter.

Cisco Systems, Inc (NASDAQ:CSCO0 ended the quarter with $47.1 billion cash and cash equivalents. The company projected that its revenue for its fiscal third quarter will decline in the range of 6% to 8%. Its guidance indicates that it might miss the estimates of analysts, which is probably the main reason for the decline of its stock price after hours on Wednesday.

Jayson Noland, an analyst at Robert W. Baird & Co. commented, “There’s a concern that emerging markets aren’t going to come back, or that their position in service providers will continue to be under pressure.” He added, “They’ve done pretty well defending themselves against traditional competitors.”

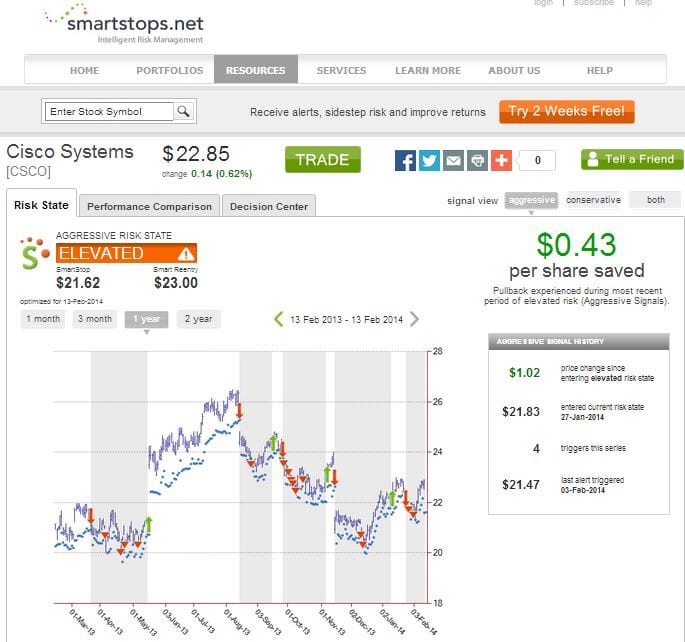

The risk management algorithms of Smartstops.net, an investment risk monitoring firm indicated that the shares of Cisco Systems, Inc (NASDAQ:CSCO) entered an elevated risk state when the stock traded at $21.47 on February 3. Investors who have portfolio protection services plan from Smartstops.net receive alerts whenever an equity touched a stock price that triggers a risk level.