The shares of BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) plummeted more than 7% to $8.41 per share after reporting that its revenue for its fiscal 2014 fourth quarter declined 64% to $976 million compared with its $2.7 billion revenue in the same period in 2013.

The struggling Canadian smartphone manufacturer said its GAAP losses from continuing operations were $423 million or $0.80 per diluted share during the period.

During the fourth quarter, BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) said hardware accounts 37% of its revenue on approximately 1.3 million BlackBerry smartphones. Services accounts 56% and software and other areas represent 7% of its revenue.

The Canadian smartphone manufacturer said it sold 3.4 million BlackBerry smartphones to end customers during the quarter. The number included shipments made and recognized before the period, which reduced its channel inventory. BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) said the total number of units it sold during the three months period included 2.3 million BlackBerry 7 devices.

The company said its adjusted gross margin for the quarter increased from 34% to 43%. Its channel inventory declined 30%. BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) said its fourth adjusted operating expense dropped 51% from first quarter of this year. It ended the quarter with $2.7 billion and cash and investments.

In a statement, John Chen, executive chairman and CEO of BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) said, “I am very pleased with our progress and execution in fiscal Q4 against the strategy we laid out three months ago. We have significantly streamlined operations, allowing us to reach our expense reduction target one quarter ahead of schedule. BlackBerry is on sounder financial footing today with a path to returning to growth and profitability.”

BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) stated that it will be able to maintain a strong cash position and will continue to look for opportunities to streamline its operations. The company projected that it will achieve a break even cash flow results by the end of its fiscal 2015.

During a roundtable discussion with the media, Chen said he does not expect the company to post a profit and revenue growth until sometime in the next fiscal year.

Collin Gillis, noted that the revenue of BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) experienced a “precipitous: drop. With regard to the performance the company’s CEO, Gillis commented, “John Chen did what John Chen is known for. He came in and he’s cut the cost base. He’s buying himself some time.”

Ross Healy, a portfolio manager at MacNicol & Associates opined that BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) is becoming an more attractive acquisition target. He added, “You can’t cut your way to revenue, but what you can cut your way to is profitability.”

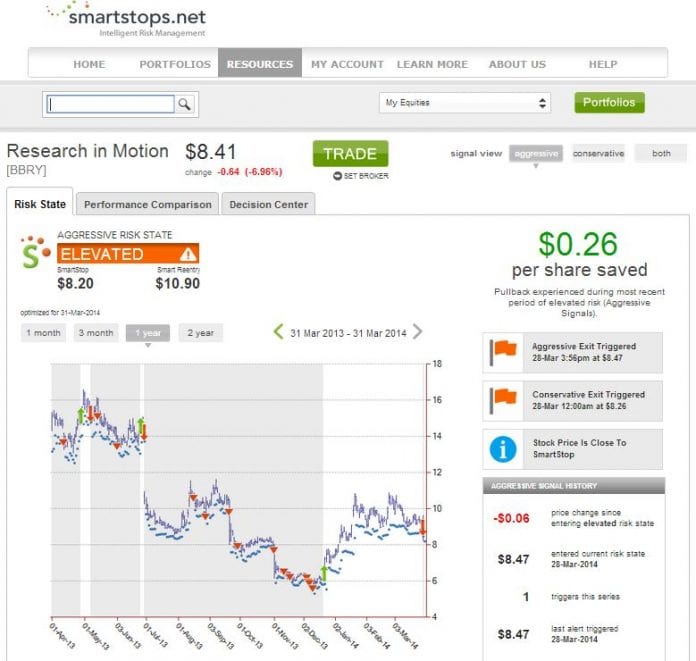

The shares of BlackBerry Ltd (NASDAQ:BBRY) (TSE:BB) is still at an elevated risk, according to Smartstops.net, an equity risk management firm that provides risk price point that can be used proactively in the next day’s trading in the stock market. The firm’s service also send alerts its members in real-time if a stock in their portfolio hit an “elevated” risk state indicating a high probability of a continued price decline. Smartstops.net’s risk management algorithms are a product of more than 40 years of stock market experience.