Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) acquired a 3.7% stake in Insurance Australia Group (ASX:IAG) for A$500 million through a share placement. The deal was part of the strategic partnership between the companies.

The strategic partnership between Berkshire Hathaway and Insurance Australia is expected to strengthen the existing relationship. It would also improve the complementary capabilities of both companies to meet customer’s needs.

Under the agreement, Berkshire Hathaway will obtain 20% of Insurance Australia’s gross written premium and pay 20% of its claims over the next ten years.

Insurance Australia will acquire the local personal and SME business lines of Berkshire Hathaway. In exchange, Buffett’s conglomerate will get the insurance rights to Insurance Australia’s large-corporate property and liability insurance business in Australia. The rights account less than 1% of its annual gross written premium.

Insurance Australia estimated that the deal will boost its ability to deliver a through-the-cycle 15% return on equity.

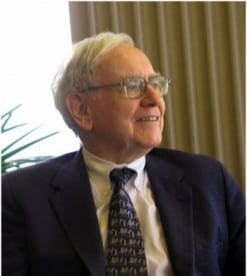

“We have worked with IAG for more than 15 years and over that time we’ve developed a good understanding and respect for their people, what they offer and the way they do business. For us, they are a natural partner with a strong management team and brand presence,” said Buffett.

Berkshire Hathaway provides significant capital flexibility to Insurance Australia

In a statement, Brian Schwartz, chairman of Insurance Australia said the partnership of Berkshire Hathaway is an endorsement of their strategy and strong franchise in the Asia Pacific region.

The partnership is also an acknowledgement of the complementary capabilities they can bring to customers. Schwartz said, “We look forward to a long and mutually beneficial relationship.”

On the other hand, Insurance Australia’s Managing Director and CEO Mile Wilkins believe that the company and its shareholders would see long-term value from the partnership, which is expected to deliver significant benefits for both companies.

Wilkins emphasized that Berkshire Hathaway’s partnership provides significant capital flexibility to Insurance Group while enhancing its ability to deliver consistent earnings. He added that Buffett’s firm also boosts Insurance Australia’s personal and SME insurance proposition. It also provides a springboard for both companies’ future business development and innovation.

Since 2000, Berkshire Hathaway and Insurance Australia have a successful reinsurance relationship. Both companies agreed to work together exclusively to improve their customers offerings under the expanded partnership.

Berkshire Hathaway obtains long-term exposure to Austalia’s market

T.S. Lim, an analyst at Bell Potte Securities, commented, “The transaction gives Buffett a significant long-term exposure to the Australian market at a reasonable risk. For Insurance Australia, it is about a long-term play. That is, having the resources and scale to frustrate the smaller players in the retail market.”

The shares of Insurance Australia were trading $5.82 per share, up by nearly 5% around 3:54 PM AEST on Tuesday, June 16.