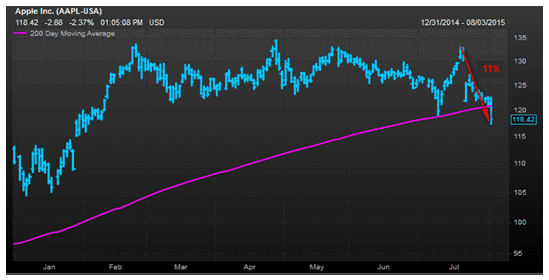

The shares of Apple Inc. (NASDAQ: AAPL) entered the correction territory after trading lower than its 200-day moving average for the first time since 2013 on Monday.

The stock price of the iPhone maker declined more than 2% to $$118.44 per share. Apple’s stock value declined 11% from its recent high at $132.97 per share on July 20.

Peter Sorrentino, a fund manager at Huntington Asset Advisors told Bloomberg, “Any time you get that type of a market leader with that big of a following, it is disconcerting to see it break trend. It is a popular stock and it had to lose speed, but for the broader market it makes one wonder if we are staring down a price correction.”

Apple shares start to decline after quarterly earnings results

Bloomberg noted that the shares of Apple traded above its 200-day moving average during the past 471 sessions. The last time, the stock declined below its threshold was in September 2013.

Apple’s shares started declining on July 21after the company reported lower-than-expected earnings for the third quarter. The tech giant posted earnings of $1.87 per share on $49.6 billion in revenue. Wall Street analysts were expecting earnings of $1.90 per share on $49.3 billion revenue.

The company’s iPhone sales of more than $47.5 million iPhone units also disappointed analysts. Investors were concerned that the recent stock market rout in China would have a negative impact on iPhones sales over the next quarters. Chinese equities lost approximately $4 trillion from June to July.

Apple CEO Tim Cook is expecting China to become its biggest market. The tech giant generated 17.4% of its revenue from China last year, according to Bloomberg.

Albert Brenner, director of asset allocation strategy at People’s United Bank Wealth Management said, a big company like Apple breaking down “would give any investors a cause of concern.”

On the other hand, Marshall Front, chief investment officer at Front Barnett Associates commented, “We’ve been in a correction of sorts, so it’s not surprising that even the strongest companies with the brightest prospects can get nixed.”

Apple can recover

Meanwhile, BTIG analyst Walter Piecyk believed that Apple shares can recover from the decline, and its earnings will increase next year.

In an interview with CNBC’s Squawk Alley, Piecyk said, “If you believe that they can grow earnings 8% to 10% in the next fiscal year then the stock should be trading a lot higher.”

He noted that a majority of iPhone uses haven’t upgraded their devices to iPhone 6, which mean the company has still “opportunity to grow” its sales performance.

“Given the popularity of the product, the demand for it and the fact that there are a lot of customers still on legacy products in the U.S. or around the world, I don’t think it’s something that going to prevent the company from growing their units,” said Piecyk.

Source: Bloomberg, CNBC