Internet retailer, Amazon.com, Inc. (NASDAQ:AMZN), has a long history of surviving downturns and sidestepping disaster. As a younger, much smaller operation during late 1999, Amazon saw its stock price inflate to around $107 before the internet bubble burst. Throughout the next ten years, Amazon’s stock had been in a range and could not break out above its internet bubble high, until late 2009 when the bulls came running back again. Since then, Amazon has seen a magnificent rise from around $65 a share in 2009 to its current $400.59 in January of 2014, almost a 700% return in five years!

Certainly, this is very impressive and Amazon really is the king of internet retailing. That being said, the company has continued to face increasing pressure from its biggest rivals, Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT), who both have revamped their web presence over the years in an attempt to take down Amazon from its ivory tower. However, Amazon is absurdly overvalued when looking at is price to earnings of 1444.79, price to book of 20.35, and its price to free cash flow of 477.71, to name a few. Additionally, there may be bigger problems lurking that investors do not realize.

That big problem is that Amazon is using its Accounts Payable to essentially run and fund its business. While this can be a useful exercise to help continue growth, Amazon has turned to heavily rely on this method and soon the house of cards will give way. According to Jeffry Chmielewski, of Seeking Alpha, “The reality is that a big chunk of Amazon’s ‘cash flow’ is really just an operating cycle game. They are really just borrowing ‘cash flow’ from suppliers as Accounts Payable”. Chmielewski goes on to compare this similar situation to what Dell Inc. (NASDAQ:DELL) experienced years earlier. Dell was able to generate lots of “cash flow” when PC sales were booming and the company had nice growth figures, but as soon as PC demand went away, Dell found itself in a dire situation. Amazon could soon find itself in a similar situation once its high growth dies down.

That’s why its so important that one recognize the changes in a trend of a stock as market leaders can drop on average 72% from their highs (source: IBD). SmartStops.net is a web-based service that can tell investors when their stock or ETF is facing an “elevated risk” which can help protect profits and limit losses.

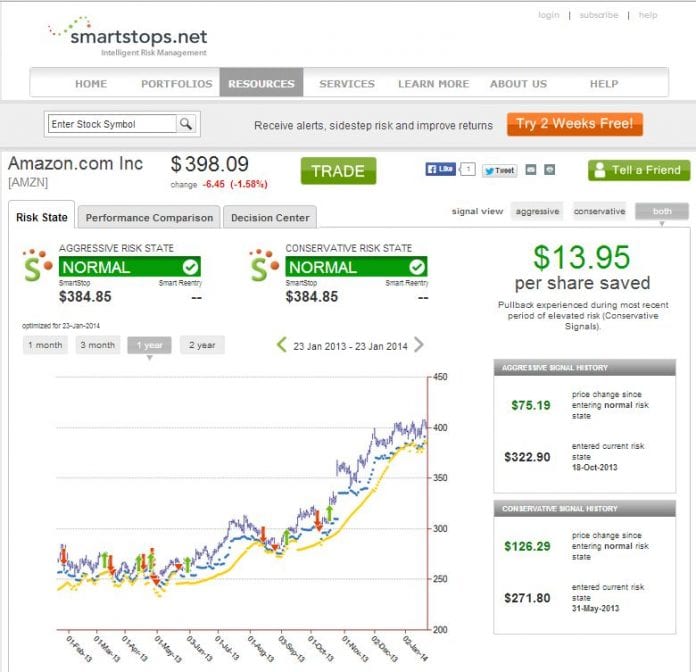

SmartStops currently has Amazon at a “normal” risk level and has since entered that state on May 31, 2013 (conservative alerts). Before that date, when Amazon had elevated risk, SmartStops gave subscribers a safe risk level that potentially saved those who took action $13.95 per share. Additionally, since the conservative reentry, indicating risk has resumed to normal , a $129.10 gain has ensued. SmartStops is yet another tool in an investors arsenal that can help sidestep downturns and keep a portfolio protected.

Source: SmartStops

In the end, Amazon must find a way to continue generating growth without the expense of issuing more debt and relying on its Accounts Payable. As we have seen from the outcome of other companies using this strategy, it is like a house of cards, all is well until the cracks become too much and it all collapses.