The shares of Amazon.com, Inc. (NASDAQ:AMZN) and Pandora Media Inc (NYSE:P) declined significantly as investors were disappointed by the earnings guidance provided by both companies for the second quarter. The two companies were among those that led the losses in the U.S. stock markets on Friday.

The stock price of the e-commerce giant plunged 9.88% to $303.83 per share. Yesterday, Amazon.com, Inc. (NASDAQ:AMZN) reported better-than-expected earnings results for the first quarter. The company earned $0.23 earnings per share on $19.74 billion revenue compared with the $0.21 earnings per share on $19.42 billion revenue consensus estimate of Wall Street analysts.

On the other hand, the shares of Pandora Media Inc (NYSE:P) fell 16.63% to $23.51 per share. The internet radio service provider reported disappointing financial performance for the first quarter. The company earned $0.13 per share on $180 million revenue compared with the $0.14 per share on $174.96 million revenue forecasted by analysts.

Amazon.com’s 2Q guidance

Investors were disappointed because the e-commerce giant projected operating losses between $55 million to $455 million next quarter as the company continues to invest cash expanding its business such constructing more warehouses to accelerate shipments and introducing more products and services such as the Fire TV set-top box.

Analysts’ perception

Aaron Kessler, an analyst at Raymond James lowered its rating for the shares of Amazon.com, Inc (NASDAQ:AMZN) from Strong Buy to Outperform and reduced his price target from $443 to $391 per share citing the company’s continued high level of investments and slowing unit growth and media sales.

In a note to investors, Kessler wrote, “While we remain positive longer-term on Amazon, the continued significant investment cycle is not showing any signs of letting up and we believe AWS is likely facing increasing price competition (Amazon CEO noted hundreds of millions of savings to AWS customers over the next several months).”

Kerry Rice, an analyst at Needham & Co. said. “We are cautious about Amazon’s ability to sustain its revenue growth given the decelerating growth in Media revenue, paid units, and active accounts […] we are less confident that the significant investments in new products, content, geographic expansion, and delivery options can produce a material contribution to sustain growth in the near-to-mid-term. Moreover, these investments coupled with capex for facilities and infrastructures have pushed operating expenses to new levels, which more than offset the improving gross margin and limit EPS growth.”

Is Amazon’s stock at risk?

Smartstops.net, an equity risk management firm shows that the shares of Amazon.com, Inc. (NASDAQ:AMZN) are currently at an elevated risk state. The firm sent aggressive exit alerts to investors today. Those who pulled back their investments when the stock entered its most recent period of elevated risk saved $56.07 per share.

Pandora second quarter outlook

For the second quarter, Pandora Media Inc (NYSE:P) expected to generate zero to $0.03 earnings per share and revenue in the range of $213 million to $218 million. Wall Street analysts were anticipating $0.05 earnings per share on $219.34 million revenue.

Analyst recommendation

Richard Tullo, an analyst at Albert Fried & Company believed that Pandora Media Inc (NYSE:P) is facing a “significant growth rate decline” and suggested that investors should exit their investment in the company.

“We think investors need to depart the bus and seek alternate modes of transportation… If we are right and 1Q represents more than a seasonal dip and investors may be paying too much for Pandora shares which are transitioning from a secular growth story to a more slow growing seasonal growth story …”

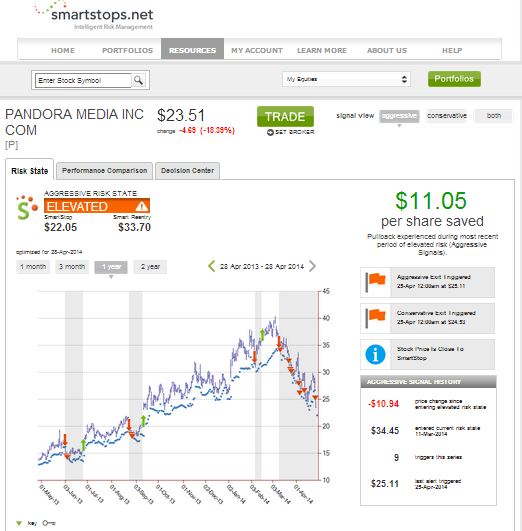

Is Pandora’s equity at risk?

Investment risk management firm, Smartstops.net shows that the shares of Pandora Media Inc (NYSE:P) are currently at an elevated risk state. An aggressive exit trigger was sent to investors today. Those who already exited their investment at the time when the stock entered its most recent elevated risk level saved $11.05 a share.